CommonWealth Magazine, “Connecting the Lobbying Dots,” March 8, 2018

By Bruce Mohl

THE LEGISLATURE DIDN’T DO a whole lot last year, but the state’s top lobbying firms kept rolling along.

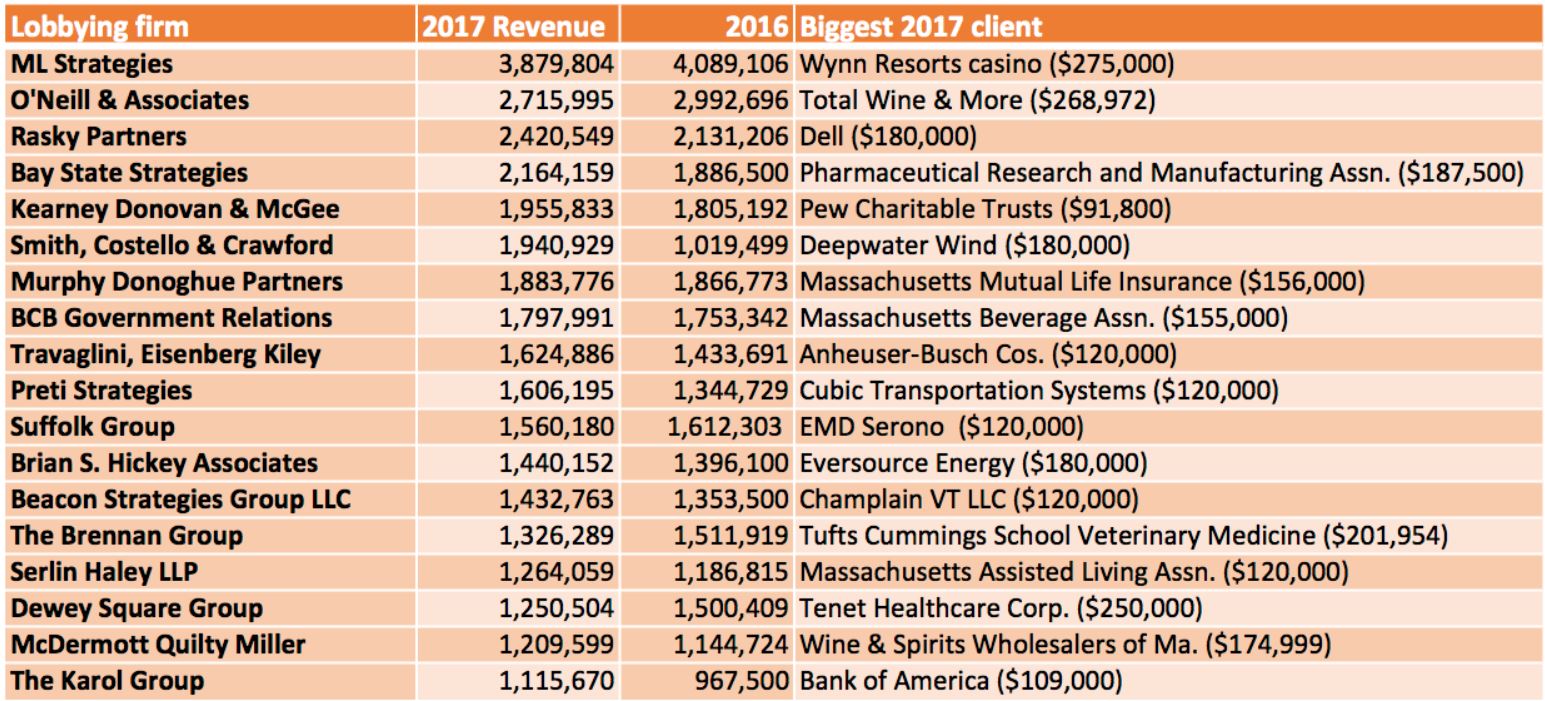

ML Strategies, the lobbying arm of the Mintz Levin Cohn Ferris Glovsky and Popeo law firm, and O’Neill and Associates retained their top-of-the-heap status, although fees at both firms were off slightly from 2016. ML Strategies came in at just under $3.9 million, while O’Neill was just over $2.7 million.

ML Strategies’ biggest client was Wynn Resorts, which is building a casino in Everett. Fees were $275,000 in 2017, well down from 2015 when the Las Vegas company spent $654,277 on lobbying. But the Wynn spending is likely to pick up this year in the wake of Steve Wynn’s resignation for alleged sexual misconduct, which has prompted an investigation by the Massachusetts Gaming Commission into whether the company should be allowed to retain its casino license.The pecking order underneath the top two firms generally remained the same, although a few lobbying companies seem to be gaining business. The firm of Smith, Costello and Crawford reported lobbying fees of $1.9 million in 2017, a sharp increase from the $670,150 it earned in 2014. The firm has dramatically expanded its client base, and benefited from state’s growing interest in clean energy. Its biggest client in 2014 was the now-closed Brayton Point coal power plant ($96,000 in fees); its top client in 2017 was Deepwater Wind ($180,000 in fees), one of three firms vying for a state offshore wind contract this year.

Beacon Strategies is another company that benefited from the state’s interest in clean energy. Beacon was retained by Champlain VT LLC, an electric transmission firm that competed unsuccessfully for a state contract to import hydro-electricity from Quebec via Vermont. Beacon collected $120,000 for its work.

Preti Strategies appears to be attracting clients interested in state transportation business. Its biggest client last year was San Diego-based Cubic Transportation Systems ($120,000 in fees), which won a huge contract from the MBTA in November to install and operate a new cashless fare system that will allow riders to pay with smart phones, bank cards, and MBTA fare cards. Preti also landed CRRC Ma, the Chinese company that is building new Red and Orange Line cars for the T in Springfield. Preti received $100,000 in fees from CRRC in 2017.

Total Wine & More, a Maryland-based retail chain that is trying to change a number of Massachusetts regulations covering alcohol sales, is stepping up its lobbying activity. It paid O’Neill $108,000 in 2016 and upped that amount to $268,972 in 2017.

To read the article on CommonWealth Magazine’s website, please click here.